Nationwide's plans are thorough but pricey. Check to see what coverage you get from your travel cards first.

Updated Aug 30, 2023 2:03 p.m. PDT · 3 min read Written by Carissa Rawson Carissa Rawson

After spending seven years in the U.S. Air Force as an Arabic linguist, Carissa is now a freelance writer using points and miles to fund a four-year (and counting!) adventure. She previously worked as a reporter for The Points Guy. Her writing has since been featured in numerous publications, including Forbes, Business Insider, and The Balance. When she's not flying, you'll usually find her in a Priority Pass lounge somewhere, sipping tea and cursing slow Wi-Fi.

Assistant Assigning Editor Meghan CoyleMeghan Coyle started as a web producer and writer at NerdWallet in 2018. She covers travel rewards, including industry news, airline and hotel loyalty programs, and how to travel on points. She is based in Los Angeles.

Fact Checked

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Table of Contents

MORE LIKE THIS TravelTable of Contents

MORE LIKE THIS TravelAre you considering purchasing travel insurance for your next vacation? It could be a good idea, especially in an era of overbooked flights, travel delays and lost luggage. Insurance company Nationwide can sell you travel insurance, which will cover you in the event that things stray from the plan.

Let’s take a look at Nationwide travel insurance, the policies available and the benefits that they provide.

Nationwide offers two different travel insurance plans for its customers: an Essential option and a Prime version. As the name implies, Prime provides more coverage and is more expensive.

With the essential plan, you'll have benefits like trip cancellation or interruption, coverage for medical emergencies and a fixed fee for delayed/lost luggage. The prime plan includes missed connection reimbursement, and generally, a higher reimbursement amount per benefit.

To do a proper Nationwide travel insurance review, we input a search for a 28-year-old from Michigan traveling to France for three weeks on a $7,000 trip.

$600 ($150 daily limit / minimum 6-hour delay required).

$2,000 ($250 daily limit / minimum 6-hour delay required).

10 day wait, if insurance purchased within 10 days of initial trip payment.

10 day wait, if insurance purchased within 21 days of initial trip payment.

Cancel for any reason (CFAR)

Up to 75% of nonrefundable trip cost.

Accident & sickness medical expense

24-hour accidental death and dismemberment (AD&D)

Emergency medical evacuation and repatriation

$500 included in medical coverage.

$750 included in medical coverage.

Baggage & personal effects

$600 ($250 per article limit, $500 combined max for specific items).

$2,000 ($250 per article limit, $500 combined max for specific items).

$100 after 12 hours.

$600 after 12 hours.

Repatriation of remains

Pre-existing conditions exclusion and waiver

60 day look back, 10 day waiver (certain conditions apply).

60 day look back, 21 day waiver (certain conditions apply).

A quick Nationwide travel insurance review shows that you’ll see quite a few more benefits associated with the Prime plan, though neither option is especially cheap. Coverage areas that are missing from the Essential plan include missed connection reimbursement, itinerary change reimbursement and 24-hour AD&D insurance, though this last one can be added on.

The Essential plan also sees significant drops in the monetary reimbursement you can expect when things go awry. Despite being only 38% cheaper than the Prime plan, coverage is significantly stripped down. You can especially see this with baggage delay ($100 versus $600), lost baggage ($600 versus $2,000) and trip delay ($600 versus $2,000). Trip cancellation is basically the only coverage area that remains the same — 100% no matter which plan you choose.

No review of Nationwide travel insurance would be complete without mentioning add-ons. Your available options will differ based on the plan you choose.

Cancel For Any Reason (CFAR)

75% of nonrefundable trip cost (purchase within 21 days. Certain conditions apply. +$338.10 for this quote).

24-hour Accidental death and dismemberment

$5,000 plus $100,000 flight only (+$12 for this quote). $10,000 plus $250,000 flight only (+$28). $25,000 plus $500,000 flight only (+$58).Accidental death and dismemberment (flight only)

Included with 24-hour AD&D add-on.

$100,000 (+$13 for this quote).Rental car insurance

$25,000 (+$207 for this quote).

As you can see, the available options and their costs can range quite a bit. If you’re looking for maximum coverage, it’s easy to more than double the cost of your original quote.

The most expensive add-on is only available to Prime policyholders. Cancel For Any Reason insurance allows the ultimate in flexibility as it’ll refund you up to 75% in trip costs in the event you want to cancel your trip.

Those opting for an Essential plan can also choose to purchase 24-hour AD&D coverage, which comes included with the Prime policy. Doing so includes flight-only coverage for Essential plans, though strangely that’s considered an add-on for Prime.

Finally, rental car insurance is available regardless of which plan you pick, though you can receive more coverage with the higher-tier Prime policy.

Many different travel credit cards provide complimentary trip insurance when you use your card to pay. Check these before purchasing travel insurance.

As nice as it would be to purchase fully comprehensive travel insurance, the truth is that nearly all policies have exclusions of some kind. This may mean that your policy won’t cover instances of COVID-19 or the decision to jump out of a plane.

Here are some general exclusions you can expect:

Accidental injury or sickness when traveling against the advice of a physician. Participation in canyoning or canyoneering, extreme sports or bodily contact sports. War or any act of war whether declared or not.Exclusions vary based on the policy and where you live, so you’ll want to read your guide to benefits carefully to see what coverages apply to your policy.

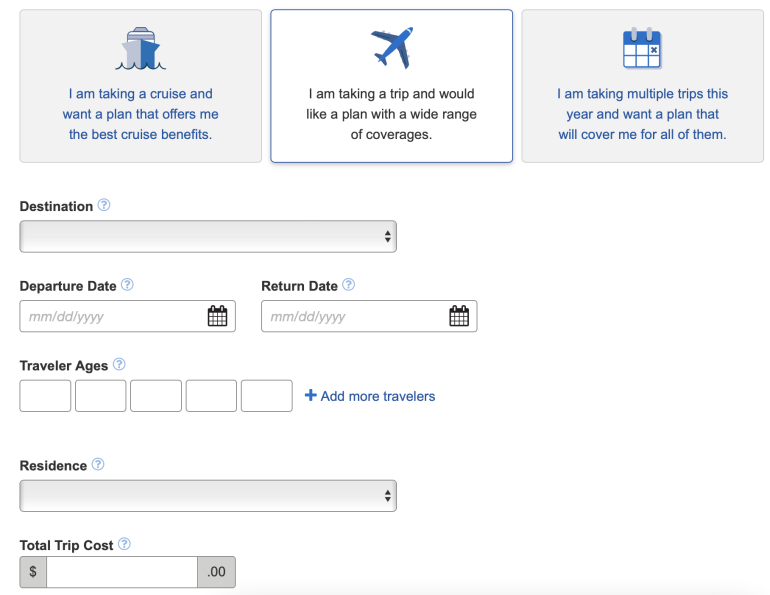

If this Nationwide essential travel insurance review has spurred you to make a decision, it’s simple to find a quote for yourself. You’ll need to navigate to Nationwide’s travel insurance page , where you’ll find a form asking for your personal information.

In addition to single-trip coverage, Nationwide also provides multi-trip plans and plans focused on cruises.

Frequently asked questions Is Nationwide travel insurance any good?Nationwide has been in operation since 1925 and is a well-established insurance provider. They offer a range of insurance policies including car, motorcycle, homeowners, pet, farm, life and travel insurance. Nationwide's travel insurance policies can be purchased for cruises , single trips or multi-trips.

What is covered under Nationwide travel insurance?Nationwide travel insurance plans have various benefits including trip cancellation, interruption or delay, financial default, missed connection, itinerary change, Cancel For Any Reason (CFAR), medical emergencies, 24-hour accidental death and dismemberment (AD&D), pre-existing conditions exclusion and waiver, and baggage delay. Each policy is different, so you'll want to ensure you read the fine print to know your coverage.

Does Nationwide travel insurance cover cancel for any reason?Nationwide's essential plan does not cover Cancel For Any Reason. However, for an additional cost, you can add CFAR to Nationwide's Prime plan. With that coverage, you will be eligible for reimbursement of up to 75% of nonrefundable trip costs. Note that this must be added on within 21 days of your first trip payment.

How does Nationwide trip insurance work?If you need to submit a claim, you'll first call the CBP Claims Department at 888-490-7606. A representative will provide a claim form and a list of documents to submit. Claims can then be submitted via U.S. mail, fax or through email. Assuming your claim is reimbursable, you'll receive payment via direct deposit or a check.

Is Nationwide travel insurance any good?Nationwide has been in operation since 1925 and is a well-established insurance provider. They offer a range of insurance policies including car, motorcycle, homeowners, pet, farm, life and travel insurance. Nationwide's travel insurance policies can be purchased for

, single trips or multi-trips.

What is covered under Nationwide travel insurance?Nationwide travel insurance plans have various benefits including trip cancellation, interruption or delay, financial default, missed connection, itinerary change, Cancel For Any Reason (CFAR), medical emergencies, 24-hour accidental death and dismemberment (AD&D), pre-existing conditions exclusion and waiver, and baggage delay. Each policy is different, so you'll want to ensure you read the fine print to know your coverage.

Does Nationwide travel insurance cover cancel for any reason?Nationwide's essential plan does not cover Cancel For Any Reason. However, for an additional cost, you can add CFAR to Nationwide's Prime plan. With that coverage, you will be eligible for reimbursement of up to 75% of nonrefundable trip costs. Note that this must be added on within 21 days of your first trip payment.

How does Nationwide trip insurance work?If you need to submit a claim, you'll first call the CBP Claims Department at 888-490-7606. A representative will provide a claim form and a list of documents to submit. Claims can then be submitted via U.S. mail, fax or through email. Assuming your claim is reimbursable, you'll receive payment via direct deposit or a check.

Are you looking for strong coverage over a wide range of incidents? Nationwide could be a good travel insurance option for you, but only if you’re willing to shell out for its more expensive policy.

That being said, if you hold a travel credit card, odds are that you already have some form of complimentary travel insurance. You’ll want to check this first to see if those benefits are enough for your trip — if not, a Nationwide insurance policy could offer the coverage that you need.

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card No annual fee: Wells Fargo Autograph℠ Card Flat-rate travel rewards: Capital One Venture Rewards Credit Card Bonus travel rewards and high-end perks: Chase Sapphire Reserve® Luxury perks: The Platinum Card® from American Express Business travelers: Ink Business Preferred® Credit Card About the authorYou’re following Carissa Rawson

Visit your My NerdWallet Settings page to see all the writers you're following.

Carissa Rawson is a freelance award travel and personal finance writer. Her work has been featured in numerous publications, including Forbes, Business Insider, and The Points Guy. See full bio.

Cards for Travel Insurance from our Partners

on Chase's website

Chase Sapphire Reserve® NerdWallet RatingNerdWallet's ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed (such as cash back, travel or balance transfer) and the card's rates, fees, rewards and other features.

Rewards rateEarn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

Intro offerEarn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

on Chase's website

Chase Sapphire Preferred® Card NerdWallet RatingNerdWallet's ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed (such as cash back, travel or balance transfer) and the card's rates, fees, rewards and other features.

Rewards rate5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

Intro offerEarn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

on Chase's website

Southwest Rapid Rewards® Plus Credit Card NerdWallet RatingNerdWallet's ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed (such as cash back, travel or balance transfer) and the card's rates, fees, rewards and other features.

Rewards rateEarn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

Intro offerEarn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

MORE LIKE THIS Travel

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105